Bariatric surgery can be a life-changing decision, but it’s important to tread carefully when considering the financial aspects. Just like any significant investment in your health, it’s crucial to avoid common financial mistakes and pitfalls. In this blog, we’ll explore some key pointers to help you make informed financial decisions and avoid common financial mistakes when booking your bariatric surgery.

Do Your Homework:

Before diving into the world of weight loss surgery, take some time to research reputable clinics and surgeons. Read reviews, ask for recommendations from trusted sources, and check the credentials of the medical professionals involved. This initial research can help you avoid falling into the trap of unscrupulous clinics promising unrealistic results at unbelievably low prices.

Beware of Unrealistic Promises:

One of the most common financial pitfalls is falling for clinics that make lofty promises. If a clinic guarantees unrealistic weight loss without effort or minimal downtime, it’s a red flag. Legitimate weight loss surgery comes with its challenges and a commitment to a lifestyle change. Be cautious of clinics that greatly downplay these aspects and only focus on the benefits.

Understand the Full Cost:

Weight loss surgery costs involve more than just the surgery itself. There are preoperative consultations, post-op care, follow-up appointments, and potential complications to consider. Ensure you have a clear understanding of the full financial picture, including hidden costs, before committing. Transparency is key in avoiding financial surprises down the road.

The benefit of booking your surgery with a company like TreVita is the encompassing all-inclusive package. Other than getting to San Diego, your entire experience is covered under your quoted price: preoperative consultations, post-op care, follow-up appointments, hotel and facility expenses, and more.

Financing Deals:

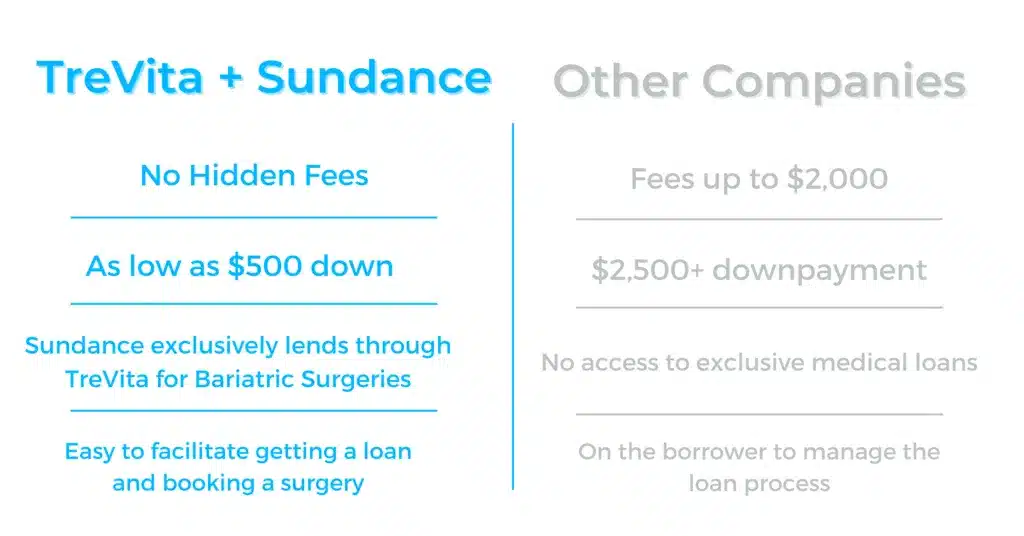

While financing options can make weight loss surgery more accessible, they can also lead to financial mistakes if not thoroughly evaluated. Be wary of deals that seem too good to be true. Some clinics may offer zero-interest financing but have hidden fees or high penalties for late payments. Always read the fine print and consider consulting a financial advisor before signing any financing agreements.

TreVita’s exclusive relationship with Sundance Medical Financing ensures that you won’t have to deal with any hidden fees or jump through difficult hurdles to get a loan for this life-changing surgery.

Insurance Coverage:

While it’s essential to check your insurance policy to see if weight loss surgery is covered, it’s worth noting that navigating the insurance route can often be a hassle. Insurance plans may cover part or all of the procedure, but the eligibility criteria can be stringent and time-consuming to meet. Even if you qualify, the process can involve frustrating delays due to the bureaucracy and approval processes. In contrast, considering options like undergoing weight loss surgery in Mexico can be easier on your wallet and your patience. It often involves fewer hassles, quicker approval, and significantly lower costs, making it a more accessible and efficient choice for many individuals seeking this life-changing procedure. So, while exploring insurance options is important, exploring alternatives can often lead to a smoother and more cost-effective journey towards better health.

Avoid High-Pressure Sales Tactics:

Some clinics may use high-pressure sales tactics to push you into making a quick decision. Be cautious if you feel rushed or pressured to commit without having the time to evaluate your options thoroughly. Legitimate clinics will give you the space and information you need to make an informed choice.

Conclusion: Financial Mistakes with Bariatric Surgery

Weight loss surgery is a significant step towards a healthier life, but it’s essential to approach it with a clear understanding of the financial aspects. By doing your research, understanding the full cost, scrutinizing financing deals, and seeking professional advice, you can avoid common financial mistakes and make a well-informed decision that benefits both your health and your wallet. Remember, your long-term well-being is worth the effort, and avoiding financial pitfalls is a crucial part of the journey.